We are currently finalizing this page to ensure compliance with international sanctions, national regulations, and to provide our best service to the community. In the meantime, we invite you to visit our General Education page, which offers a comprehensive set of financial resources. If you have any questions or need urgent assistance, please feel free to reach out to us via email or through our Contact page!

The ‘Nation Profile’ section is a brief yet informative look at China’s economic and financial history, current standing and future trends.

Overview: The banking system in Argentina has long been characterized by volatility and recurrent economic and financial crises. Over recent decades, regulatory efforts have focused on enhancing reporting standards, increasing due diligence in the allocation of government spending, and modernizing oversight of the financial sector. These initiatives aim to address persistent challenges such as high inflation, currency instability, and an unsustainable debt burden. However, as reforms continue, tensions remain between the federal government’s policy objectives and the operational realities of the banking sector.

Argentina faces complex challenges similar to those seen in other emerging economies. Efforts to restructure failing businesses and implement stricter banking regulations have sometimes conflicted with the need to sustain private sector investment and market confidence. The balance between protecting depositors, managing public expectations, and restoring fiscal discipline has led to periods of instability within the financial system.

The International Monetary Fund (IMF) adopts a cautiously optimistic view of Argentina’s financial reforms. While the nation’s reform agenda and economic potential are recognized, the IMF also highlights serious concerns, including ballooning public debt, persistent inflationary pressures, and a history of financial disruptions. These factors complicate efforts to achieve long-term economic stability and align the goals of both the public and private sectors.

Argentina’s history is marked by several sovereign debt defaults over the past few decades. Unlike a single instance of default, these recurring events have stemmed from chronic fiscal imbalances and external shocks, undermining Argentina’s credibility in international capital markets. While past defaults have prompted necessary reforms and access to various funding avenues, they have also imposed lasting challenges on the nation’s ability to secure stable financing.

Definitions

Sources

Inflation is the rate at which the general level of prices for goods and services rises, and subsequently, purchasing power falls. It’s a key economic indicator that is closely monitored by governments and central banks worldwide. Causes of inflation can include increased production costs, higher demand for goods and services, and changes in government policy.

Overview: Inflation is the rate at which the general price level of goods and services rises, eroding purchasing power over time. It’s vital to understand inflation because if your income does not increase at the same pace as inflation, your spending power decreases, making it harder to afford the same lifestyle and save for future goals.

Inflation profile: In 2024, Argentina’s inflation rate was estimated to be around 50%, significantly higher than the global average of 5.2%, underscoring persistent economic instability. The sectors most affected by inflation are healthcare, education, and public utilities. In the healthcare sector, inflation has been driven by soaring input costs—especially for imported pharmaceuticals and medical supplies—while government subsidies and price adjustments have helped partially mitigate consumer impacts. The education sector has experienced mounting inflationary pressures, as rising private education fees and operational costs weigh on families, even though increased public spending has helped cushion some of these effects. Public utilities and miscellaneous services have also been influenced by fluctuating energy prices and elevated service costs, keeping overall inflation pressures pronounced.

On the other hand, the transportation and communication sectors have seen some moderation in price increases, largely due to technological advancements and regulatory measures that have helped reduce operational expenses. The food sector, which contributes a significant portion to the Consumer Price Index (CPI), has experienced mixed trends. While global commodity trends and volatile exchange rates have pushed up prices for some food items, government interventions and local production surpluses have helped stabilize others. Non-food categories such as clothing, housing, and personal services continue to display volatility, reflecting the broader challenges of policy implementation in an economy marked by structural imbalances.

Argentina’s unusual inflation in 2024 is due to long-running budget deficits, unstable exchange rates, and deep-rooted economic problems. Low local demand and outside pressures—like shifting commodity prices and capital outflows—have made inflation worse. Ongoing wage-price cycles—where rising wages push up prices, which then lead to demands for even higher wages—and struggles to keep steady monetary policy, have also kept inflation high.

What is being done (National level): In response to the high inflation rate, the Central Bank of Argentina (BCRA) has introduced a series of measures aimed at stabilizing the economy. These include tightening monetary policy, controlling the money supply, and implementing stricter exchange rate policies to curb the depreciation of the peso. Alongside these monetary measures, the government has also rolled out targeted subsidies and social welfare programs to support vulnerable communities. While these efforts are designed to restore confidence and limit hyperinflation—when prices rise uncontrollably and rapidly erode purchasing power—challenges from deep-rooted structural issues have led to mixed results, including temporary slowdowns in inflation but continued pressure on wages, savings, and investor confidence.

What can you do? Unfortunately, there are few straightforward solutions to combat high inflation, apart from reducing your exposure to the currency undergoing inflation.

Examples of Stable Cryptocurrencies

Live Inflation Link

Definitions

Sources

Banks are for-profit, public financial institutions offering a wide variety of financial tools and services. Credit unions are nonprofit, member-owned cooperatives often offering lower fees and higher savings interest rates.

Overview: Credit unions and banks are both vital financial institutions. Credit unions are member-owned not-for-profit entities with lower interest rates. Banks are shareholder-owned for-profit organizations with wider service offerings, such as investment tools, credit cards, customer service, and more locations.

Banking Profile: Argentina’s banking system has evolved significantly over the past century, particularly since the economic reforms of the 1990s and the financial crisis of 2001. The Central Bank of the Argentine Republic (BCRA) is the primary authority responsible for monetary policy, currency issuance, and banking supervision. Historically, Argentina’s banking sector has experienced periods of instability tied to inflation, capital controls, and economic downturns, but recent regulatory improvements have increased resilience and oversight¹.

Argentina’s banking network is composed of a mix of state‑owned banks, domestic private banks, and foreign‑owned institutions. Among the most prominent public banks is Banco Nación, which plays a central role in development finance and supports agricultural and industrial sectors². Other major state‑owned institutions include Banco Provincia and Banco Ciudad. These banks often serve social and regional development goals, and may operate with policy‑driven mandates that can limit their operational flexibility.

The private banking sector includes institutions such as Banco Galicia, Banco Macro, and BBVA Argentina. These banks operate under more market‑oriented frameworks and have greater flexibility in commercial decision‑making³. Foreign‑owned banks like Santander Río and HSBC Argentina also play a significant role, often focusing on high‑income individuals and corporate clients.

Argentina’s banking sector is regulated by the BCRA and supervised in collaboration with the Comisión Nacional de Valores (CNV) for capital markets compliance. The sector has faced persistent challenges, including inflation volatility, currency controls, low credit‑to‑GDP ratios (about 35% of GDP), and public mistrust stemming from past crises⁴. Capital flight and dollarization remain significant concerns, especially during election cycles or policy shifts.

To promote financial stability, Argentina implemented a deposit insurance system—SEDESA (Seguro de Depósitos S.A.)—in 1995, which insures deposits up to ARS 1.0 million (approx. USD 1,600) per depositor per bank⁵. The system covers savings and checking accounts at banks authorized by the BCRA and aims to bolster public confidence by guaranteeing timely payouts in case of institutional insolvency.

Despite frequent macroeconomic shocks, Argentina’s banking system has shown notable resilience in recent years. Banks have strengthened capital requirements, diversified their loan portfolios, and expanded digital services. Regulatory bodies have also enhanced risk controls and tightened oversight of foreign exchange operations. Efforts to improve financial inclusion—especially for rural and low‑income populations—have led to the expansion of mobile banking and fintech partnerships, under BCRA’s evolving regulatory framework⁴.

While Argentina’s banking environment can be complex, particularly in times of macroeconomic uncertainty, keeping funds in a regulated bank is still considered significantly safer than holding large amounts of cash. Funds in a bank are protected by deposit insurance and can earn interest, while also offering access to payment services, credit products, and investment tools. However, customers should verify their bank’s regulatory standing, deposit insurance participation, and risk exposure. In conclusion, Argentina’s banking sector continues to adapt and modernize, striving to increase public trust, expand access, and maintain stability amid challenging economic conditions.

Bank Recommendations:

Bank Name |

Banco de la Nación Argentina |

BBVA Argentina |

Definitions

Sources

Online and Mobile Banking provide convenient access to your financial accounts at any time and anywhere. Manage your money securely from your computer, tablet, or smartphone with features like bill pay, mobile deposits, and account monitoring.

Overview: Mobile banking allows users to conduct financial transactions and manage their accounts using a smartphone, tablet, or computer. It typically involves accessing a banking app or website to check balances, transfer funds, pay bills, deposit checks remotely, and receive account notifications.

Benefits of Mobile Banking

Banks and Credit Unions with Mobile Banking

Bank Name |

Reliable Peer-to-Peer (p2p) Payment Platforms

P2P App Name |

Concerns about Online Banking

Sources

Currency and currency exchange are important to any nation’s economy, influencing transactions from everyday grocery shopping to international trade. Monitoring the strength of a currency and its global exchange rate is crucial, as these factors can significantly affect the cost of daily commodities and the preservation of personal wealth.

Overview: Currency is the official medium of exchange used within a specific country or region, composed of banknotes and coins issued by the government. Currency exchange is the process of converting one currency into another at a determined rate, crucial for international trade, travel, and investment. This exchange is facilitated by banks, currency exchange services, or financial institutions, with exchange rates influenced by factors like supply and demand, economic conditions, and geopolitical events.

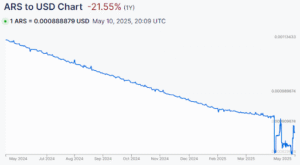

Overview (Nation Specific): In Argentina, the national currency, the Argentine Peso (ARS), operates under a managed floating exchange‐rate system overseen by the Central Bank of Argentina (BCRA). Since the abandonment of the peso’s 1:1 peg to the U.S. dollar in early 2002—after a decade under this Convertibility Plan—the BCRA has alternated between free floats, strict capital controls (“cepo”), and managed bands to tame chronic inflation and stabilize the currency [1][2]. In April 2025, as part of a US $20 billion Extended Fund Facility with the IMF, Argentina adopted a “dirty” float allowing the peso to trade within a moving band of ARS 1 000 to ARS 1 400 per U.S. dollar—widening by 1 % each month—with the BCRA intervening only at the band’s edges to smooth excessive swings [3][4][5].

What this means for individuals and businesses in Argentina is that the peso’s value is now more directly influenced by global supply-and-demand dynamics. In the short term, this can produce significant volatility: a weaker peso immediately raises the local‐currency cost of imported goods, fuel, and foreign travel, while periods of appreciation can offer temporary relief on those same expenses [6][7].Additionally, the coexistence of multiple exchange rates—the official rate, the MEP (“Dólar MEP”) and CCL (“Contado con Liquidación”) financial market rates, and the informal “blue” rate—means that many Argentines must navigate parallel markets to access dollars, often paying a substantial premium [8][9]. Over the long run, however, a transparent, rule-based band backed by IMF‐supported reserve injections is intended to rebuild confidence in peso-denominated assets, expand investment options, and foster greater financial stability across the economy [10].

Definitions

Sources

Remittances are funds sent by foreign workers to their home country, often serving as a significant source of income for their loved ones in their home country. These transfers, usually made through banks or money transfer services, can exceed official development aid amounts and contribute significantly to a country’s GDP and communities.

Overview: Remittances refer to money sent by individuals working abroad to their home country, usually to support family members or for other purposes. These transfers often occur through specialized remittance services or international money transfer platforms, facilitating economic support and development in the recipient country.

Recommendations for the best way to send remittances

Service Provider (Link Included) |

Sources

Retirement planning is the process of determining retirement income goals and the actions necessary to achieve those goals. It involves identifying sources of income, estimating expenses, implementing a savings program, and managing assets. This planning is crucial for maintaining a comfortable lifestyle after work, and it’s recommended to start as early as possible.

Overview: Retirement plans are financial strategies aimed at helping individuals save and invest for their post-employment years. These plans, which can include employer-sponsored options and personal savings accounts (High Yield Savings), offer various benefits and investment opportunities tailored to individuals’ needs. Participants contribute regularly to these accounts during their working years, with the aim of building a financial cushion to support their retirement lifestyle.

Nation Specific:

Argentina’s retirement system is built around a multi-pillar framework designed to provide both universal basic coverage and supplementary benefits. The core is the Sistema Integrado de Jubilaciones y Pensiones (SIJP)—a pay-as-you-go, solidarity-based scheme financed by employer and employee contributions at the national level, with a collective capitalization fund serving as a sustainability buffer [1]. A second tier formerly offered individual accounts through private Administradoras de Fondos de Jubilaciones y Pensiones (AFJPs) from 1994 until their elimination in 2008, after which all affiliates were consolidated into the public system [2][5]. Retirement eligibility requires 65 years of age for men and 60 for women, plus a minimum of 30 years of contributions [3]. Contributions average around 18 % of wages, split between employers and employees [4]. Although the system is nearly universal—covering public, private, and self-employed workers—provincial schemes and special regimes (e.g., military, police) create regional disparities in benefits and funding health [7]. In recent years, high inflation and austerity measures have strained pensioners: over 52 % of retirees now live in poverty, and pension increases lag behind inflation, prompting calls for reform [9]. The current administration has signaled openness to systemic changes—including revisiting contribution rates, mobility clauses, and possible partial privatization or dollarization schemes—but detailed proposals remain under discussion [10].

What can I do?

Definitions

Sources

Estate planning is the process of organizing your personal and financial affairs to prepare for the possibility of mental incapacity and eventual death. It involves creating legal documents such as wills and trusts, and taking inventory of assets. The goal is to preserve the maximum amount of wealth possible for the intended beneficiaries.

Overview: Estate planning is a transfer process that involves making preparations during a person’s life for the management of their estate in the event of death or mental incapacitation. It encompasses various aspects, including wills, trusts, beneficiary designations, powers of appointment, property ownership, gift, and powers of attorney. The goal is to ensure the greatest possible value of the estate is preserved while considering tax implications and any potential legal problems. If an estate plan is not agreed upon by the individual, the government will decide how to distribute their assets once presumed dead.

The most common type(s) of estate planning

How a transfer process takes place

At the time of death in Argentina, if the deceased has left a valid will, their assets are distributed according to its instructions. In the absence of a will, the estate is considered “intestado,” and the Argentine Civil and Commercial Code dictates how the assets are allocated. A legal process called “sucesión” is initiated, during which a judge appoints an administrator—usually a close relative—to handle the estate. This includes identifying heirs, settling outstanding debts, and ensuring the proper distribution of property among legal beneficiaries such as the spouse, children, and, in some cases, parents or siblings.

The court plays a supervisory role throughout the process to ensure legal compliance and fairness. If no rightful heirs are identified, the estate may eventually pass to the state, although this is uncommon due to efforts made to locate potential heirs. Without a will, the succession process can be more time-consuming and may lead to disputes among family members. For this reason, individuals are strongly encouraged to seek legal assistance to draft a will and organize their estate in advance to avoid complications for their loved ones.

Estate Tax Rates

In Argentina, there is no national inheritance or estate tax, so heirs generally do not pay federal taxes on inherited assets. However, some provinces—such as Buenos Aires—impose a local inheritance tax called the “Impuesto a la Transmisión Gratuita de Bienes,” which ranges from 1% to 4% depending on the amount inherited and the heir’s relationship to the deceased.

Even without this tax, heirs may still face other costs, including legal and court fees during the succession process and property transfer taxes for real estate. It’s recommended to consult a local legal or tax advisor to understand specific regional requirements.

Definitions

Sources

Income tax is a financial charge imposed by governments on the income or profits of individuals or entities. It applies to various forms of income, including salaries, wages, business profits, and unearned income, such as interest, dividends, and capital gains.

Overview: Income taxes are the portion of your earnings that you’re required to pay to the government. They fund public services like schools, roads, and healthcare.

Tax Brackets

Income tax brackets categorize taxpayers into different groups based on their income levels, with each group subject to a specific tax rate corresponding to their earnings.

Tax rate | Taxable Income Threshold (AR) |

5% | 0 – 126 697,64 |

9% | 126 697,65 – 253 395,27 |

12% | 253 395,28 – 380 092,91 |

15% | 380 092,92 – 568 139,04 |

19% | 568 139,05 – 1 136 278,08 |

23% | 1 136 278,09 – 1 704 417,12 |

27% | 1 704 417,13 – 2 556 625,68 |

31% | 2 556 625,69 – 3 784 013,52 |

35% | Over 3 784 013,53 |

Common Tax Deductibles: A tax-deductible is an expense that can be subtracted from an individual’s or business’ taxable income, reducing the amount of income subject to taxation.

Nation Specific Deductions

Tax Returns

A tax return is a form submitted to the tax authority that reports income, expenses, and applicable deductions to calculate taxes owed or potential refunds. In Argentina, depending on an individual’s financial situation and income level, they may be required to file a tax return. It is recommended to consult with a tax professional to determine eligibility and receive guidance on the filing process.

Due Date for Taxes

In Argentina, the tax year runs from January 1st to December 31st. For individuals, income tax is generally withheld by employers, but those with additional income or certain financial situations may need to file an annual tax return. The individual income tax return is typically due between mid-April and June 30th of the following year. For businesses, income taxes are paid in monthly or advance installments, with the annual income tax return and final settlement due within five months after the close of the fiscal year.

The stock market is a complex network where shares of companies are bought and sold. It plays a crucial role in global economies by enabling money to move between investors and companies.

Overview: The stock market is a public arena where shares of companies are traded at agreed prices. It’s a universal mechanism for companies to raise capital and for investors to gain partial ownership in these companies. The price of a company’s stock is subject to fluctuations based on numerous factors such as supply and demand, the company’s financial health, and wider economic indicators. While the stock market can present risks, it also offers a significant avenue for wealth creation over time.

Stock Market Profile

Argentina’s financial market is centered around the Buenos Aires Stock Exchange (Bolsa de Comercio de Buenos Aires – BCBA), which is the country’s primary securities market. As of 2024, the total market capitalization of domestic companies listed on the BCBA was estimated to be over 100 billion USD. The Comisión Nacional de Valores (CNV), Argentina’s national securities commission, regulates and supervises the securities industry. In recent years, Argentina has taken steps to modernize and stabilize its financial markets, allowing increased participation by foreign investors under specific regulations set by the CNV.

Definitions

Sources

Credit scores and systems are integral to financial health, serving as a measure of an individual’s or entity’s ability to repay debts and manage credit responsibly. As it can significantly impact your ability to secure loans, mortgages, or other forms of credit, and can even influence the interest rates you’re offered.

Overview: A credit score is a numerical measurement of an individual’s creditworthiness, influenced by factors like payment history, amounts owed, and length of credit history. This score plays a significant role in determining eligibility for loans, credit cards, and even housing. A higher score can lead to better financial opportunities.

Credit System Profile

In Argentina, your credit history is tracked by private credit bureaus like Organización Veraz, NOSIS, and FELIDAS. These companies collect information such as how well you pay your bills, if you have any unpaid debts, and whether you’ve had legal or utility payment problems [1]. Instead of one national credit score, each bureau gives its own type of risk rating, which banks, stores, lenders, and fintech companies use to decide whether to give you credit and on what terms [2][3]. As of 2019, nearly all adults in Argentina are covered thanks to required data sharing by banks and utility companies [4]. People can request a free credit report from each bureau once a year and have the right to fix any mistakes by filing a dispute. The Central Bank of Argentina (BCRA) oversees this process and usually requires valid disputes to be resolved within 30 days [5].

Credit scores in Argentina generally range from 1 to 999, with higher numbers indicating better credit. While exact scoring systems vary by bureau, a score above 700 is usually considered good, while scores below 400 are seen as risky. The most common way to improve your credit score is by paying bills on time, reducing your credit card balances, and avoiding new debts or legal claims.

To improve the system, the BCRA is working on a plan to create a centralized public credit registry. This would combine data from all credit bureaus, make scoring more standardized, and simplify the dispute process [7][8].

What can I do?

In Argentina, improving your credit score involves consistently demonstrating sound financial behavior. This includes making on-time payments for loans, credit cards, and utility bills, as well as avoiding overuse of available credit lines. Delays or defaults in these areas can negatively affect your score. It is also important to avoid having multiple unpaid debts or being reported by lenders, which can further harm your standing with local credit bureaus.

To begin tracking and managing your credit, you can request your credit report from agencies like Veraz (Equifax Argentina) or Nosis. These reports provide a summary of your credit activity and any outstanding issues that might be dragging down your score. You can request a free report from Veraz every six months by phone or online, using your DNI (national ID) number. This process is considered a “consulta personal,” or soft inquiry, and does not impact your score. For deeper issues or assistance, you may also visit consumer protection offices or financial institutions for guidance on resolving negative marks and improving your financial health over time.

Definitions

Sources

Financial scams are fraudulent schemes that trick individuals or organizations into losing money. Scammers exploit various channels and use advanced techniques, including phishing attacks and investment scams.

Overview: Scams are deceptive schemes or fraudulent activities designed to trick individuals or organizations into giving away money, personal information, or other valuable assets. They often exploit trust, fear, or unfamiliarity, posing as legitimate businesses, organizations, or individuals. Common types of scams include phishing emails, fake investment opportunities, get-rich courses, romance scams, and lottery scams.

Common scams: If you’re uncertain whether something might be a scam, don’t hesitate to contact the Collatz Capital Foundation through our one-on-one form. We’re here to assist you in identifying potential scams. We also strongly encourage you to utilize Collatz as a resource to prioritize your safety. Falling victim to scams can have severe financial consequences, legal ramifications, and in some cases, even pose life-threatening risks.

Online Scams & Human Trafficking

Investment/Crypto Scams

Phishing

Dear Costumer,

We’ve detcted suspicous activity in you’re Google account. Your account may have been acessed by someone else. To protekt your account, it’s been temporarly locked.

Please **click here** to verify your identy and restore full access. Do this within 24 hours or your account will be permanantly deleted!

Best,

Googel Support

“Get rich quick” Online Courses

Business Capital Raise Scam

Online Catfishing (Pig Butchering)

Receive Money, Keep a Percentage (Money Mule/Transfer Scam)

I have fallen victim to a scam, what do I do? If you suspect you have fallen victim to a scam, please reach out to the foundation immediately via the one-on-one link provided. Depending on the details of the scam, such as severity, impact, and the safety of the victims, we may be able to offer assistance or provide guidance to mitigate negative impacts.

Sources

The Tools & Resources section encompasses tools and regional organizations that can help empower your financial journey, from budgeting to seeking aid.

Overview: The financial resources below are a compilation of apps and tools identified by Collatz that can be beneficial in one’s financial success. These range from tools in budgeting, non-profit aid and maintaining consistency in one’s financial plan.

Mobile Apps

Below is a table that includes some helpful finance resources

Resource | Description | Cost |

Ualá | Fintech | Free |

Naranja X | Fintech | Free |

Money Manager | Budgeting | Free |

Organizations & Programs

Financial terminology encompasses the specialized language(jargon) used to describe various aspects of money management, investment strategies, and economic concepts, essential for effective communication and understanding in the world of finance. Click here to learn the most common terms!

Income: The money received regularly for work or through investments.

Expenses: The costs incurred for goods, services, and bills.

Emergency Fund: Savings set aside specifically for unexpected expenses or emergencies.

Credit Card: A card allowing the holder to make purchases on credit(borrowed money), with a limit set by the card issuer.

Loan: A sum of money borrowed from a lender, to be repaid with interest.

Bankruptcy: A legal status of being unable to repay debts, resulting in a court process to resolve financial obligations.

Compound Interest: Earning interest on both the initial principal and the accumulated interest over time.

Retirement Account: A tax-advantaged investment account to save for retirement, often offered by employers.

Net Income: The amount of money left after deducting taxes and other deductions from one’s gross income.

Assets vs. Liabilities: Assets are what you own, while liabilities are what you owe. The difference is your net worth.

Credit Report: A detailed record of a person’s credit history, including credit cards, loans, and payment history.

Budgeting: Creating a plan to manage and allocate money for various expenses and savings.

Down Payment: A portion of the total cost paid upfront when making a big purchase, like a home or car.

Insurance: A financial arrangement that provides protection against financial loss or risk.

Depreciation: A decrease in the value of an asset over time.

Inheritance: Money or assets passed down to heirs after someone’s death.

Stocks: Ownership shares in a company, representing a claim on part of the company’s assets and earnings.

Mutual Fund: An investment vehicle that pools money from many investors to buy a diversified portfolio of stocks, bonds, or other securities.

Interest: The cost of borrowing money or the return on investment, expressed as a percentage.

Principal: The initial amount of money borrowed or invested, on which interest is calculated.

Simple Interest: Interest calculated only on the initial principal amount over a specified period.

Compound Interest: Interest calculated on both the initial principal and the accumulated interest from previous periods.

Rate of Interest: The percentage at which interest is charged or earned over a specified period.

Lender: An individual, institution, or entity that provides money to a borrower, typically in exchange for interest.

Borrower: An individual, company, or entity that receives money from a lender with the obligation to repay it, usually with interest.

Annual Percentage Rate (APR): The total cost of borrowing, expressed as a yearly interest rate, including fees and other costs.

Term: The period for which a loan or investment is agreed upon, influencing the total interest paid or earned.

Fixed Interest Rate: An interest rate that remains constant throughout the term of a loan or investment.

Variable Interest Rate: An interest rate that can change over time, typically influenced by market conditions.

Credit Card Interest: The interest charged on outstanding balances(money owed) of credit card debt.

APY (Annual Percentage Yield): The total annual interest earned on an investment, including compounding, expressed as a percentage.

Prime Rate: The interest rate at which banks lend to their most creditworthy customers.

Installment Loan: A loan repaid with a fixed number of equal payments over a specified period.

Interest-Only Loan: A loan where the borrower pays only the interest for a certain period before starting to repay the principal.

Usury: The illegal or unethical practice of charging excessively high interest rates on loans.

Default: Failing to meet the agreed-upon terms of a loan, such as missing payments, leading to financial consequences.

Prepayment: Paying off a loan or part of a loan before the scheduled due date.

Credit Score: A numerical representation of an individual’s creditworthiness, influencing the interest rates they may be offered.